Privacy Management GroupFZ-LLC, Ras Al Khaimah, United Arab Emirates – A company in association with the Privacy Management Group – henceforth referred to “PMG”.

These General Terms and Conditions – henceforth also referred to as “AGB”, “Terms and Conditions” or “General Terms and Conditions” – are a legally binding component of all supply, consultation, placement, service and user agreements, as well as other services not explicitly listed herein, which are provided / will be provided either directly or indirectly by PMG for the contractual partner – henceforth also referred to as mandator, client, contractual partner, interested party or also referred to as user.

1) Basic provision and utilization requirements

PMG provides all previously described services exclusively on the basis of these General Terms and Conditions. PMG may amend the General Terms and Conditions with a prior notice period of one week. PMG will post a written notice of each change, or a new version of the T&C will be marked in the according place within the website. At the same time, the client is herewith expressively notified that the respective change will be a component of the contract, existing between the contractual parties, in the event that the client does not object in writing and per registered mail, within a notice period of two weeks after the announcement by PMG, to the change. In the case that the client objects in writing, both parties have the right to terminate the contract verifiably, in writing and per registered mail, within the valid termination notice period. The client does not possess a claim for reimbursement of payments previously made to PMG.

With the visit to the website of PMG and the respective use thereof, but at the latest with contacting PMG, no matter for what reason and in which manner, the user declares in a legally binding way to agree to these Terms & Conditions, as well as to the legal & usage agreement of PMG, to have agreed and acknowledged everything without restriction. Additionally, and / or complementarily, every person who contacts PMG in person, in writing or by telephone, declares that they are a fully qualified merchant (a business person in the legal sense – not a business founder). Should a person not be in agreement with Articles of these General Terms and Conditions in addition to liability and legal notices, or should a person not be in accordance with the requirements that PMG has towards its clients, this person / client is herewith asked to leave the website immediately. PMG especially forbids such a non-qualified user to request information or offers from PMG, in particular, to not apply for and / or claim services and not to undertake other actions that would lead to a contract with PMG.

The aforementioned provisions also result in distinctive features regarding the prevailing right of revocation and withdrawal. With reference to the aforementioned provisions, a right of revocation and withdrawal is therefore categorically precluded.

Privacy Management Group places the greatest value on the prevention and fight against money laundering, financing of terrorism, organised crime and other offenses. Privacy Management Group is a regulated group of companies that fulfils the international standards concerning the fight against money laundering and financing of terrorism. Our employees are regularly subject to training courses, presented by our internal anti-money laundering representative.

PMG expressly calls attention to the fact that earnings generated abroad may also be subject to taxation in the home country of the client. In addition, PMG expressly advises every client to seek a consultation with a legal or tax advisor who is familiar with the personal financial and fiscal circumstances of the client, prior to the client taking any action. The consultation by a legal or tax advisor should, therefore, and in every case, occur prior to the conclusion of the contract with PMG. You, the client, are solely responsible for the adherence to all international tax responsibilities in your home country or abroad. PMG offers no liability towards the client or even third parties if the client does not fulfil his tax requirements, partially or in full.

All website content made available by PMG merely serves to inform the user. PMG, author / publisher, endeavours at all times to exercise due care in the creation of the posted informational offers. However, PMG expressly assumes no warranty and / or liability in respect to the accuracy, the completeness, the timeliness or the availability. The full range of content represents neither an individual recommendation nor is the content and presentation to be understood in terms of an invitation / request / offer to act, to avoid, to buy or to sell. All informational offers and presentations on these websites are exclusively oriented toward an independent and autonomous decision of the reader and do not replace a legal and / or a tax-law consultation. This is especially valid in view of all matters concerning legal or tax issues of the client, concerning the proper implementation of his plans and the thereof resulting legal and tax duties.

These above-mentioned regulations and requirements are also valid in case that the user contacts PMG in writing, verbally or personally to request information or offers from PMG. The content of all information from PMG or from third parties, irrespective of what kind, towards the user, expressively does not serve as a replacement for a thorough consultation with an experienced lawyer or tax advisor, nor do they represent a recommendation or request to undertake or to refrain from certain actions. PMG, co-workers, and representative third parties give information, in all manner, without any liability. If the user enters into a contract with PMG to execute certain actions, then PMG rightly assumes that the user has consulted an applicable tax advisor or lawyer. In no case, is PMG liable towards the user or even towards third parties for actions or omissions that are the responsibility of the user or by him commissioned third parties. Only transmitted offers in writing and individually addressed to the user by PMG possess validity. The validity period of an offer that has been addressed to the user in general lies at 48 hours, should no deviating period have been agreed upon.

The fundamental reservation concerning changes and errors applies for all publications, service offers, depictions, and prices.

(2) Occurrence of contract

Generally, a contract between the user and PMG comes into being by the user placing a request for service to PMG and PMG accepting this request by means of invoicing, order confirmation or by delivery, if applicable, execution of service. Furthermore, a contract can be legally concluded by actions and/or verbal or formlessly written orders between the user and PMG. In this, just as in any similar case, the user in a legally binding way declares towards PMG that he agrees with the Terms & Conditions and has taken notice of theses without restrictions. PMG is entitled to reject each incoming order, no matter of what nature and without naming of reasons.

(3) Service payments, compensation, fees, annual charges and public dues

Unless otherwise agreed upon between the client and PMG, every service provided by PMG for the client is to be paid in advance. Exemptions to this are postage, shipping, and telephone expenses in the context of the PMG office service. Services performed by PMG, which are not expressly included in the invoice will be billed separately to the client by PMG.

Fees agreed upon in a lump sum are expressively exempted from the duty of compensation towards PMG, except if the contractual partner demands services that go beyond the service circumference agreed upon in writing.

Service payments are payable by the client immediately and without deductions, within three bank days upon invoice date, counting from the electronic transmittal of the invoice. In the case of default, PMG is permitted to impose interest in the amount of four percentage points above the UAE discount rate per year. Should PMG be in a position to substantiate higher damages caused by the default, it is permitted to claim these. In the event of a special delay of payment, if the client does not pay the invoiced services and/or expenses within fourteen days after transmittal of the invoice by PMG, PMG is also permitted to cease all services immediately including not accepting and / or not sending on forwarded post and taking incoming telephone calls within the scope of the postal and telephone service (mail forwarding from registered address). PMG is expressly not liable for the consequences and damages resulting thereof. Should the client not fulfil his payment obligations to PMG in due time and in full, PMG will send one electronic overdue notice to the client and demand payment within a new deadline. Should the client still not comply with this notice in due time with full payment, PMG is at all times permitted to terminate the contractual relationship with immediate effect (grounds for a termination with good cause). PMG may forward the termination electronically to the client. The following categorically applies for all services offered by PMG: In the event of any kind of payment default, PMG is at that time permitted to invoke the right of retention, as regards to any and all business data and documents of the client, prior to sending an overdue notice. Upon full payment to PMG by the client of all outstanding claims, PMG declares itself at that time prepared to hand over and / or forward by mail, all of the business data and documents held back under the right of retention, to the client within 14 business days. The client is responsible for all costs arising out of the forwarding of the material, in particular, transport and shipping costs.

PMG retains the right to change running costs (i.e. annual fees, administration fees, fees for reg. office and agent, licensing fees, office service fees, trustee fees, etc.). The client is to be informed about such a change in advance by electronic means, at the latest during invoicing of the respective services. If the change of fees relates to an increase of more than 10% compared to the previous year, then the client has the right to cancel the concerned services in writing, within a notice period of 14 days after announcement thereof. If the client does not terminate or if the outstanding invoice has been paid in full, then the client documents his unrestricted and legal agreement. The client has to raise complaints about invoices in writing immediately, at least through electronic means, at the latest within 5 working days after receipt of the invoice. The right to offset only applies to the client if his countering claims have been legally determined in court and this decision having been finally accepted by PMG.

Additionally, the following regulations concerning the due date and the payment delay for annual fees (the term of annual fees describes and includes the annual administration costs, the fees of the reg. agent, the fees of the reg. office, occurring registration fees and public duties, annually reoccurring licensing fees and fees for a required license renewal, general administration fees, administration lump sums, etc.): The annual fees are to be paid by the client in a timely manner to PMG. Timely manner, in this case, means that the annual fees are booked at least 21 days before the respective final date/payment day on the account of PMG. Only in this manner can PMG guarantee that possibly in the amount contained registration fees, remunerations, public duties, etc. can be paid in a timely manner to the respective company and that, thereby, no fines for overdue will be booked to the client and his company. Should the client not transfer the annual fees within at least 21 days before the valid final date/payment day to PMG, then PMG carries no liability for additionally thereby occurring fees for overdue (also called penalty fees). In any case, this PMG and the client herewith agree upon bindingly, that PMG itself will invoice a penalty fee to the client, should the due annual fees not be paid on the final date/payment day at the latest onto the business account of PMG and be booked in full and without deductions.

The following penalties/overdue fees apply for belated payment of the annual fees by the client to PMG. At non-payment within a period of seven days until final date/payment day, the applicable penalty fee raised by the respective applicant is enlarged to fifty percent by PMG (penalty fee/administration fee). At non-payment within a period of twenty-eight days after final date/payment day, the applicable penalty fee raised by the respective applicant is enlarged to one-hundred percent by PMG (penalty fee/administration fee). Independent from that, PMG retains the right to announce the termination due to important reasons towards the client. Furthermore, all applicable regulations also apply, these have been extensively detailed in these T&C. The client is expressively instructed, that the final date/payment day for the due date of annual fees, agreed upon at the beginning of the contract, may change. This can, for example, occur due to a change of law or upon order by a respectively applicable institution. In this case, PMG is not liable for damages towards the client that have been caused by such a change.

(4) Termination periods and the termination for important reasons, transfer of a company, cancellation of an existing company

– the client is overdue with his payment towards PMG;

– the trust relationship between PMG and the client is permanently disturbed;

– a contractual partner violates repeatedly and culpably against the duties that result from the existing contractual relationship.

A termination, no matter for what reason, must take place in writing and per registered mail. Neither through a regular termination nor a termination for important reasons, can PMG be obligated to repay already possibly executed payments. In the case of termination, a repayment duty by PMG to the client is irrevocably excluded.

Should the client wish to transfer the administration of his company to a different service provider, he may declare this to PMG in the course of an ordinary termination and under adherence to agreed notice periods. The fees in connection with the transfer amount to a one-time payment of Euro 1,400.00 which is to be paid to PMG by the client before the transfer of the company. In the case of an early contract termination by the client, no entitlement to reimbursement of fees already paid exists. Notice regarding the deletion of a legal person from the relevant company and / or commercial register: PMG is able to arrange for the deletion of a legal person administered by PMG through appropriate third parties, which is subject to a charge. The fee for this service, which PMG will invoice the mandator for, is dependent on the country of residence and the legal form of the legal person. Please ask PMG to provide you with a written quote prior to the formation of a company. PMG is in no way obliged to delete existing companies, which were founded by PMG or a third party, upon a customer request. The client may request this service from PMG and submit an appropriate billable application. A commitment of acceptance of such an application will, however, only be issued through a written agreement/acceptance by PMG to the client. PMG expressively offers no aid for the termination of accounts, credit cards or other bank services.

(5) Duties of information

The client is at all times solely responsible for the correct input and / or transmission of data to PMG, which is required for the discharge of the contract, to provide requested services and / or for the use of services. The client is to notify PMG about changes of all data relevant to the contractual relationship (home address, family status, telephone number, e-mail address, significant economic changes, etc.) in writing, per registered mail and without delay, no later than seven days after a change occurs. The client is additionally required to ensure that his data on file with PMG is at all times updated, thereby ensuring a constant accessibility through the post and by digital means (e-mail). Any damages resulting for the contractual partner out of an inability by PMG to reach him in writing will not be assumed by PMG (e. g. fines due to missing a deadline, checks, missed objection periods, etc.). PMG is not required to perform research. Should the client fail to inform PMG in writing and in due time about changes in his contact details, notifications that arrive with PMG for the client (office service) and written statements, will be considered to have been duly delivered to the client, if they have been sent to the last known postal address or e-mail address available to PMG. PMG is not liable for any damages that hereby occur to the client or his company or even unknown third parties.

The client is required to check the information provided for the execution of the mandate (company name, product designation, logos, domain names, etc.) for instances of any potential copyright and / or trademark infringement or other violations of the rights of third parties. PMG, commissioned trustee bodies and other with PMG connected companies and natural persons are not liable in this regard, whether directly or indirectly, towards third parties in any way.

At no time do PMG and the client enter into an ownership structure or cooperation with one another. The client is to refrain from anything that may give third parties such an impression. Additionally, the client is expressly prohibited from connecting his company with PMG in any way towards third parties. The client is furthermore not authorised to refer to PMG, its employees or its agents in connection with his company, his work, etc. by name. A violation by the client against this regulation is considered to be a good cause for termination. PMG expressively reserves its right to claim for damages and to file for other civil and criminal judicial actions.

Should the client use a trustee service, he is expressly not permitted to identify natural persons as officers of his company. The trustee service of PMG mediates and is carried out by legal persons, and only these may be referred to as “bodies of the company” externally and to third parties. Should the client violate this provision, PMG is entitled to terminate with good cause. PMG expressly reserves its right to claim for damages and to file for other civil and criminal judicial actions.

(6) Liability of PMG

PMG is liable, according to a legal determination, only when attributable violations of obligations are based on wilful intent or gross negligence or PMG violated an essential contractual obligation at least through gross negligence. Apart from that, liability and / or a claim for damages against PMG are precluded.

Generally, all claims must be submitted immediately, whether justified or unjustified, by the client to PMG in writing (letter per registered mail), at the latest seven days after delivery, the provision of services, occurrence of damage, etc. Otherwise, the claim, even in justified cases, of the client for compensation, adjustments or even replacement by PMG is void without substitution. If on the delivered service or at the product, changes have been undertaken, then generally, the liability claim is void. The liability duty of PMG towards the client is generally restricted to adjustments or replacement. In the case of justified and timely claims, the client is entitled to repair or replacement of the service by PMG. In the case of a legitimate notice of deficiency, the deficiency will be corrected within a reasonable time, whereby the contractual partner must facilitate PMG to undertake all necessary measures to investigate and correct the deficiency. PMG is entitled to refuse to repair the service if the repair is impossible or results in a disproportionately high expenditure for PMG. Deficiency claims of the client or an announced reason for compensation of the client have categorically to be proven flawlessly by the client in court. In the case of a legally and flawlessly proven and justified compensation claim towards PMG, already now it is bindingly agreed upon by PMG and the client: If a violation leading to compensation duty by PMG is proven flawlessly in court, already now it is agreed upon that PMG is liable only up to an amount of EURO 1,000.00, independent of the size of the determined actual damage. Compensation claims lapse according to the legal regulations, nevertheless, the latest with the expiration of one year after the execution of the non-contractual service. Generally, a reversal of the burden of proof by PMG is excluded. The detection of the deficiency at the time of the hand-over and the timely manner of the compensation claim have to be proven beyond reasonable doubt by the contractual partner.

PMG cannot fundamentally guarantee that the desired name will be entered into the relevant commercial and / or company register. PMG is expressly not liable for damages incurred by the client / interested party as a result of a specific name and / or a subsidiary not being registered, even if this name has already been verbally confirmed by PMG in advance. The application for state and / or public licences and public permits requires the consent of an appropriate and legitimate public authority and / or public body for the issuance thereof. Such decisions are by nature not foreseeable. For this reason, PMG accepts no liability for the rejection of applied-for licences / permits and the resulting consequences concerning the results or /and the duration of application. PMG is not liable for consequences, damages or other disadvantages due to the rejection of the applied license/permit and the thereby caused delays for the client, no matter of what manner. Unless, the delay is based directly on a timely delay that is provingly caused by gross negligence or intent on the part of PMG. This regulation is valid for all services, to be executed by PMG, that a client receives or releases an order for. PMG, therefore, is also not liable for timely delays during the account opening (inc. credit cards, online banking) or account closure, for timely delays during the issuance or even the transfer of documents, and so forth. The client is always required to prove gross negligence or intent, beyond a reasonable doubt.

(7) Commissioning of suitable third parties and liability

PMG is entitled, at their discretion to carry out the requested and / or ordered services of the mandator themselves, to avail themselves of the provision of services covered by the contract by appropriate third parties and / or to substitute such services (“supply agent”).

PMG will carefully select supply agents and ensure that these are in possession of the required specialist qualifications. The banking service segment, active aid for the opening of business accounts is the sole responsibility of PMG, while the Privacy Management Group Ltd., Cyprus, may serve as a performing agent. The offered and mediated trustee service of PMG, nominee director, a nominee shareholder, and the secretary is always performed by third parties, so-called trust companies. PMG is, in this case, the only mediator between the client and the mediated trust company. For disputes or even damages out of this contractual relationship between the trust company and the client, PMG is expressively not liable. This exclusion of liability is especially applicable towards third parties. A trust director, trust shareholder (also called nominee director or nominee shareholder) and/or trust secretary (trust company) are expressively not liable for the success or failure of the client. In particular are the trustee and/or the nominated secretary not responsible for the fulfilment of fiscal duties of the client and/or his company. A liability on the part of PMG and the mediated trust company is also excluded in the case that they conclude a contract with third parties upon instruction of the client. PMG and the trust company, in general, are not liable for damages, neither directly nor indirectly, towards the client, his company or even unknown third parties. The client has to inform each of his contractual partners that the position taken by trustees in his company is in fact occupied by trustees. Furthermore, he has to take care that neither the trustee nor PMG can be held liable/be liable towards third parties in any way. The client and his company are solely and exclusively liable for all existing or future contractual agreements towards third parties, for every kind of fiscal debt, for violation of laws of any kind, locally or abroad, for competition violations, for the complete business area and other circumstances that occur due to the client and/or his company undertaking or refraining from his/their duties. The client is at this point expressively again notified, that the profits generated at home/at his place of residence can be objected to fiscal duties. It is alone the clients’ duty to consult a lawyer and/or tax advisor concerning this matter and to be regularly accommodated by them. The trusteeship mediated by PMG and executed by the trust company is not allowed to be used by the client to undertake illegal activities and/or to give a wrong impression towards third parties. PMG and the mediated trust company, besides its’ bodies, are to be kept clear of all duties towards third parties. Contractual obligations, except towards the client within the framework of the concluded trustee contract, the trustee does basically not enter into in this connection. Also, and especially, not towards third parties. Should the client violate this rule, then PMG is entitled to terminate due to important reasons. Compensation claims and other civil and legal steps are expressively reserved by PMG and the trust company towards the client and his company.

PMG is solely responsible for the area of the Office Service; agent hereby is the Privacy Management Group Ltd. in Cyprus.

(8) Account opening and participation duty of the client

It is within the sole discretion of the bank (following all financial institutes, a provider of merchant accounts and other financial service providers are titled with the term “bank”), to accept or reject an application for account opening, online banking or even credit or debit cards. The assignment of PMG consists exclusively therein to introduce you to the desired bank and to actively accompany you throughout the account opening process. However, PMG assumes no guarantee that your envisioned company/corporate account will be approved and successfully opened/activated by the bank. PMG expressively points out, that every bank has the right to demand documentation, information, translations, receipts and attestations from the client, that extend beyond the limit of required proof depicted by PMG. Hereby, additional, not foreseeable costs and fees may arise for the client. For this reason, respective depictions on websites of PMG and verbal or written information of PMG towards the client, also concerning this matter, are non-binding and solely serve the purpose of overall orientation.

Incomplete applications or not correctly filled out form sheets can delay the process of account opening. Should the bank that the client envisioned, object the account application or reject it with or without mentioning of reasons, then the clients possess no right to a refund of the fees paid to PMG. A refund of the fees already paid by the client expressively also does not take place, if the client complicates the account opening unnecessarily for PMG or if PMG terminates the contract due to important reasons. An important reason, for example, exists in the following cases:

– The client does not comply with his informational and presentation duties, which are essential for an account opening, within a reasonable period – or

– The client makes incomplete or even false statements towards PMG and/or the bank– or

– The behaviour or statements of the client towards PMG lets the bank or even PMG suspect that the account that is being applied for is not being opened for the specified business reason – or

– The client rejects, even after written request by PMG, to present the information, documentation, etc. required in this connection in a complete and timely manner, latest within seven working days after request by PMG – or

– The trust relationship between PMG and the client is damaged in such a way that it seems impossible for PMG to execute the order in an orderly fashion – or

– PMG, the bank or the authorities at any time receive substantiated information that the client is engaged in unethical, anti-competitive or even illegal and / or criminal practices and / or is indirectly or directly taking part or took part in the same. Information obtained from the internet (for example from search engines) expressly suffices as so-called “substantiated information”. This also applies to “information not further substantiated” from cooperating banks or from appropriate authorities, whereupon PMG is informed that there are grounds that speak against a business relationship with the client, this would keep PMG from engaging in a business relationship with the client – or

– The commercial bank cooperating with PMG and selected by the client refuses, for whatever reasons, to work with the client of PMG. Such a rejection also represents a case for termination with good cause.

In all of the aforementioned cases, the claim of the client to reimbursement of payments made by him or upon his instruction to PMG is precluded. A termination due to important reasons has generally to take place in writing. Fees, which PMG raises towards the client for account mediation/aid for account opening, are only for the previously mentioned services and exclude mailing fees, documentation or even banking fees. All previously mentioned regulations refer expressively to the mediation or aid for the opening of an e-Money account, merchant account and other similar products and services.

(9) Guaranteed account opening

PMG guarantees, in connection with selected company establishment, the opening of a business account for the respective to be newly established company. PMG ensures with this “guarantee” towards the client an active, engaged and professional aid for the opening of the account envisioned by the client, including the active support of the application for account opening, preparation of the respective documentation and the correspondence with the bank during the account opening procedure. This guarantee loses its validity without replacement if the circumstances and/or reasons under one of the points mentioned in (8) of these Terms & Conditions leads to the termination for important reasons and/or should lead to the account opening not taking place. In this case, it is also conclusive within the under point (8) mentioned depictions of these Terms & Conditions, that the client is not entitled to a refund of already made payments to PMG, neither partially nor as a whole. It generally lies exceptionally in the estimation of the bank, the financial institute, the respective provider of similar products to approve or reject an application for account opening, online banking, and credit or even debit card, etc.

For better understanding, the term “bank” used in this T&C describes, besides the business banks, also financial institutes, credit card companies, and similar institutions.

(10) Offer service

The client has to ensure in this regard towards PMG and his own interests that every required participation, availability, all information, personal as well as company data, is provided for the execution of the service. Storage media provided by the client must be in perfect working order with regard to content and technical quality. Should this not be the case, then the client will replace to PMG all damages resulting from the use of these storage media. Should the client not perform his necessary active contribution, not perform it on time or not perform it to the extent necessary, the implications resulting thereof are the responsibility of the client. PMG reserves the right of ownership of the delivered products and services until the full payment of all demands arising out of the contract.

PMG is not liable for the replacement of data or programmes, insofar as the loss by PMG was not caused by willful intent or gross negligence. Liability will only be considered in such a case, if the client has ensured through appropriate measures, that the initially saved data or programmes can be replaced at a reasonable cost.

PMG assumes no liability for damages and delays through disruptions of the computer system, the data network, actions of third parties, or force majeure – also not for the text content of any type. The contractor is only liable for damages resulting from gross negligence or wilful intent.

You, the user, are solely responsible for the adherence to deadlines by third parties. For this reason, PMG is not liable for damages resulting from cases of postal delivery not being and / or could not be made in a timely manner to you. The user alone bears the responsibility to enquire regularly at PMG about the receipt of items of mail.

Claims: A claim will only be acknowledged by PMG if it is a justified claim, that has been submitted in writing within seven business days after knowledge by the client. Should changes have been made to the service provided, the warranty claim is void. The warranty claim is limited to repairs and replacement service. Liability exists only for damages resulting from gross negligence or willful intent by PMG. Damages have to be proven judicially and flawlessly. In the case of a judicially clearly proven and by the client documented compensation claim towards PMG, already now it is bindingly agreed upon: If PMG is proven judicially to be at fault, which has led to the client or a third party having experienced damages directly, then PMG is liable to a maximum amount of one annual fee of the client, according to the Office Service Package chosen at PMG. For complete flawlessness i.e. at writing tasks, no liability can be claimed. Compensation claims expire according to the legal regulations, but latest with the expiry of one year after the execution of the contractual service.

(11) Further regulation concerning liability, compensation, and claims

PMG expressively notes, that all by PMG publicised or in other forms mediated, or transmitted information and declarations are only of a general nature. The application in each case should only take place after consultation with a legal or fiscal advisor. For all, without this consultation occurring errors, no liability can be accepted.

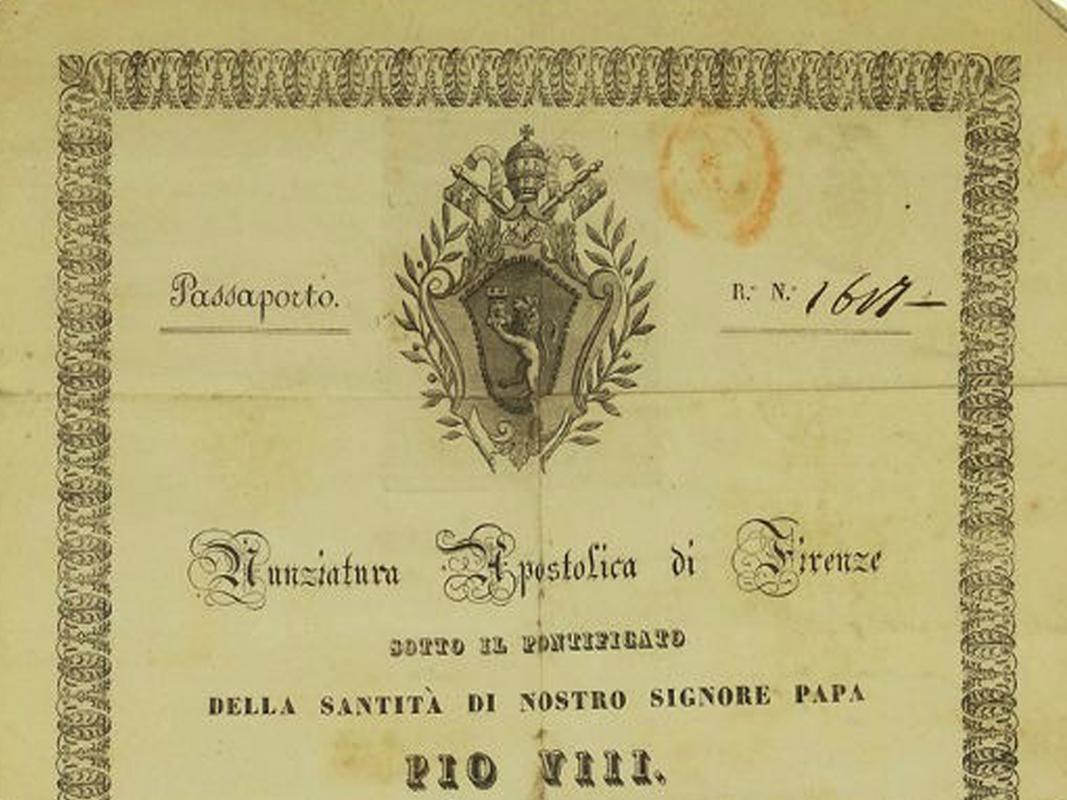

On all web pages of PMG, PMG introduces itself and its work. Consultation only takes place with individual clients and after extensive evaluation of the individual conditions. For this reason, PMG does not take responsibility for any conclusions of the customer, for his personal planning or even decisions. PMG offers, as depicted in these Terms & Conditions, no tax or legal consultation. The client should, for this reason, already before availing of our services (i.e. establishing a company, before the opening of a bank account and/or relocation of residence or acquiring a passport, etc.), have closely consulted a tax or legal consultant. Furthermore, this is also valid for every service that the client avails of, either directly through PMG or through a contractual partner of PMG. Each client is requested to consult extensively with specialized legal or tax consultants in their home country. PMG expects for each phase, that the client complies/has complied with this request.

Generally and basically, PMG is according to the legal regulations, only liable if an accountable breach of duty is based on wilful intent or gross negligence or if PMG has, due to gross negligence, committed a significant contractual violation. Apart from that, liability or even a claim to compensation from PMG is excluded. The liability of PMG is also excluded, should the client not accord to his reporting obligations or his informational duties or other than in these Terms & Conditions described circumstances lead to the contractual relationship between PMG and the client being terminated.

Generally, all complaints, whether justified or not, must firstly be reported by the client to PMG in writing (letter per registered mail) within seven working days after delivery or provision of a service. Otherwise, the claim of the client of compensation, adjustment or even replacement by PMG is void. Should changes have been made to the undertaken service, then the liability entitlement is cancelled. In the case of justified and timely complaints, the client has the right to adjustments or exchange of the service by PMG. At justified complaints, the defects are corrected within an applicable period, thereby, the contractual partner has to enable all required measures for the evaluation and correction of the defect. PMG is entitled to reject the service if this is impossible or would be connected to a disproportionately great effort.

A claimed damage / a claim of the client towards PMG concerning compensation claims must always be proven beyond reasonable doubt by the client in court. In the case of a judicially doubtlessly proven and justified compensation claim towards PMG, already now it is bindingly agreed upon between PMG and the client: has an obligatory erroneous behaviour by PMG been proven in court, then PMG is liable to a maximum amount of 1,000.00 Euro, independent of the size of the determined damage. Compensation claims expire according to the legal regulations, however, at the latest with the expiry of one year after the execution of the non-contractual service. Categorically, a reversal of the burden of proof at the expense of PMG is excluded.

(12) Rights of retention

For all claims of PMG, that arise from the contractual relationship between the client and PMG, the client categorically is liable with his total wealth. PMG is towards the client, in the case of open claims, basically also entitled to withhold all services, is entitled to use its right of termination due to important reasons, to reclaim already provided services, to withhold documents and written papers that are stored at PMG (also in digitalised form etc.), to apply for bankruptcy of the respective established company of the client, to delete the company in the register at the expense of the client, or even to claim the company. The right of a legal complaint against the client due to non-payment remains in any case, as well as the possibility of PMG of obtaining an international default summons against the client. PMG expressively retains the right to judicial steps against the client, as well as the right to compensation.

(13) Choice of law and place of jurisdiction

The laws of the United Arab Emirates, Ras Al Khaimah Emirate, apply to the contractual relationship between PMG and the client. The place of jurisdiction for all disputes arising from the contractual relationship between the client and PMG is the location of PMG.

(14) Final Declaration

Should single provisions of this contract be invalid or inexecutable or after the conclusion of the contract become ineffective or inexecutable: To replace the ineffective or inexecutable regulation, the effective and executable regulation shall come to bear, whose effects of economic targets are the closest to the intention of the contractual parties with respect to the ineffective or inexecutable regulation. The above regulations are valid in case that the contract shall prove to be incomplete.

United States persons (including U.S. citizens and residents) are subject to U.S. taxation on their worldwide income and may be subject to tax and other filing obligations with respect to their U.S. and non-U.S. accounts – including, for example, Form TD F 90-22.1 (Report of Foreign Bank and Financial Accounts (“FBAR”). U.S. persons should consult a tax advisor for more information.

Version: AGB04.2016